Elder Fraud Statistics 2025: FTC Reports $2.4 Billion Lost to Scams Targeting Seniors

TL;DR: According to the FTC's December 2025 report, scams targeting seniors resulted in $2.4 billion in reported losses in 2024—and the real number may be as high as $81.5 billion. Investment scams, romance scams, and government impersonators are the biggest threats.

In this article, we're going to discuss

- The $2.4 Billion Problem: What Scammers Don't Want Your Parents to Know

- 📈 By The Numbers: A Four-Year Fraud Explosion

- 🎯 The "Big Four" Scams Hitting Older Adults Hardest

- 💰 The Eye-Popping Loss Leaders

- 📱 How Scammers Make Contact

- 💳 How Scammers Get Paid

- 👴 The 80+ Factor

- 🚨 The FTC Impersonator Epidemic

- 🌟 The Silver Lining

- 🛠️ What You Can Do TODAY

- 🔗 Resources

- The Bottom Line

The $2.4 Billion Problem: What Scammers Don't Want Your Parents to Know

Picture this: Your mom gets a call from "Microsoft" saying her computer has a virus. Your dad gets a text from "Amazon" about suspicious activity. Your grandmother receives an urgent message from the "FTC" demanding she protect her savings immediately.

Spoiler alert: None of these are real.

The Federal Trade Commission just dropped their annual "Protecting Older Consumers" report, and folks... the numbers are wild. Let's break down what's happening and how to help the older adults in your life stay safe.

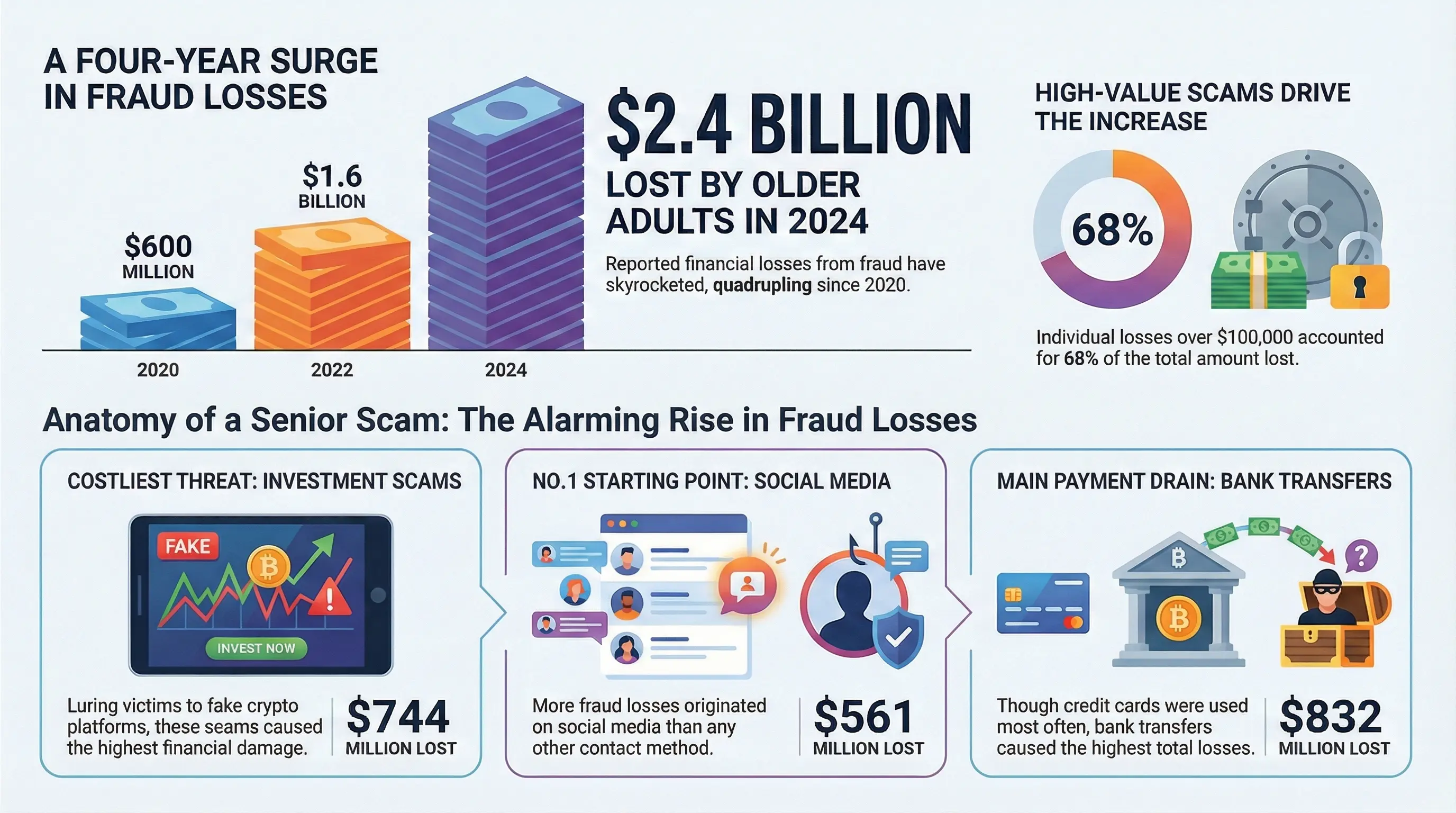

📈 By The Numbers: A Four-Year Fraud Explosion

| Year | Total Losses (60+) |

|---|---|

| 2020 | $600 million |

| 2021 | $1.0 billion |

| 2022 | $1.6 billion |

| 2023 | $1.9 billion |

| 2024 | $2.4 billion |

That's a 300% increase in just four years. And here's the kicker—these are only the reported losses. The FTC estimates the real number could be anywhere from $10.1 billion to $81.5 billion. Yes, with a B.

🎯 The "Big Four" Scams Hitting Older Adults Hardest

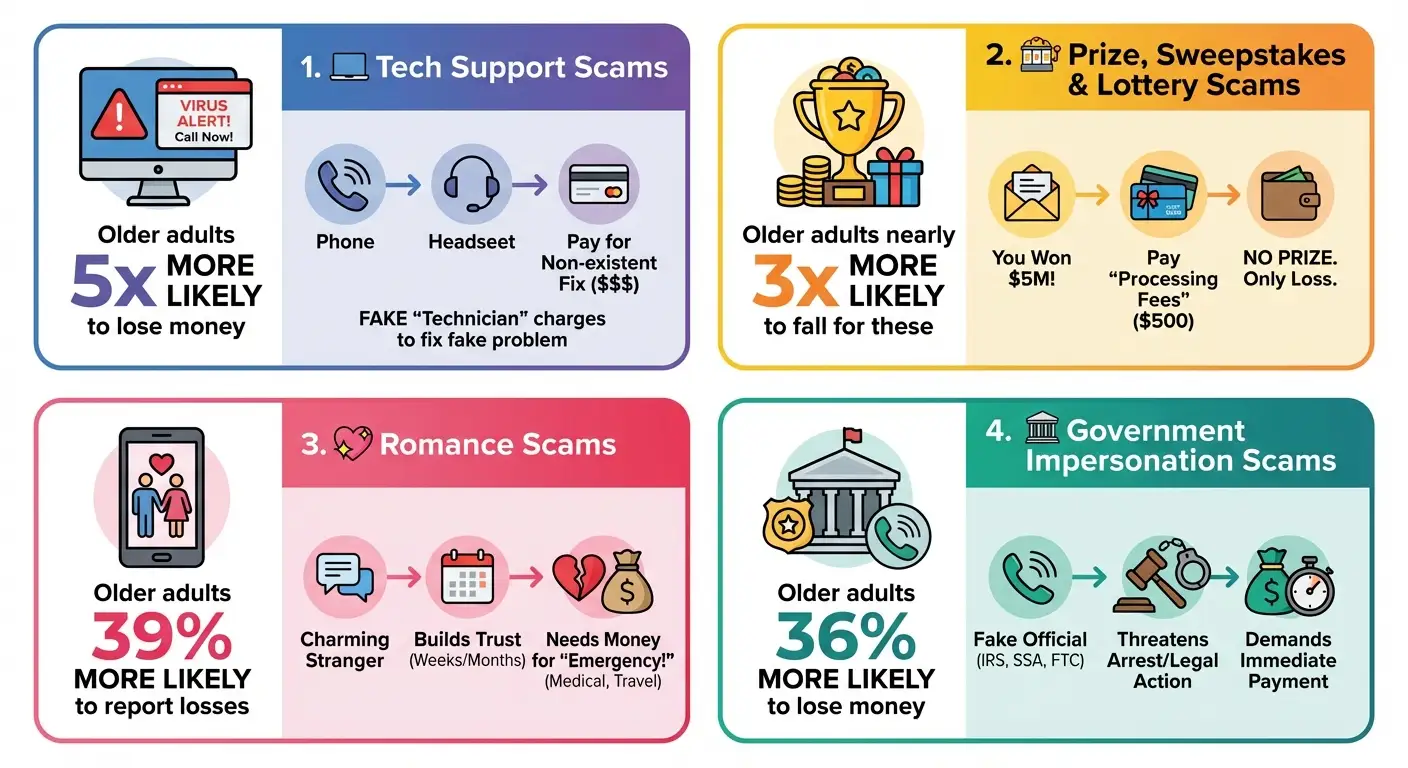

1. 💻 Tech Support Scams

Older adults are 5x more likely to lose money here than younger people.

The setup: A scary pop-up appears saying your computer is infected. Call this number immediately! The "technician" then charges hundreds or thousands to "fix" a problem that never existed.

2. 🎰 Prize, Sweepstakes & Lottery Scams

Older adults are nearly 3x more likely to fall for these.

The setup: "Congratulations! You've won $5 million! Just pay $500 in gift cards for processing fees." (Spoiler: There is no prize. There are only tears.)

3. 💕 Romance Scams

Older adults are 39% more likely to report losses here.

The setup: A charming stranger online builds a relationship over weeks or months, then suddenly needs money for an emergency, medical bills, or to finally meet in person.

4. 🏛️ Government Impersonation Scams

Older adults are 36% more likely to lose money to these.

The setup: Someone claims to be from the IRS, Social Security, Medicare, or even the FTC itself, threatening arrest or legal action unless payment is made immediately.

💰 The Eye-Popping Loss Leaders

Here's where older adults' money actually went in 2024:

| Scam Type | Total Losses | Change from 2023 |

|---|---|---|

| Investment Scams | $744 million | ⬆️ +38% |

| Business Imposters | $377 million | ⬆️ +21% |

| Government Imposters | $375 million | ⬆️ +47% |

| Romance Scams | $329 million | ⬆️ +19% |

| Tech Support Scams | $159 million | ⬇️ -9% |

Investment scams are the real monster here, often involving fake cryptocurrency platforms promoted on social media.

📱 How Scammers Make Contact

Here's a plot twist many people don't expect:

#1 Contact Method: Social Media — $561 million in losses

That's right. More than phone calls. More than email. Social media is now the top way scammers reach older adults.

But here's the nuance: Phone calls still cause the highest individual losses at a median of $2,210 per victim. Social media casts a wider net, but phone scams go deeper.

| Contact Method | Total Losses | Median Loss Per Victim |

|---|---|---|

| Social Media | $561M | $650 |

| Phone Call | $502M | $2,210 |

| Website/App | $303M | $272 |

| Text Message | $183M | $1,560 |

💳 How Scammers Get Paid

The payment methods tell their own story:

Highest Total Losses:

- 🏦 Bank Transfers — $832 million

- 🪙 Cryptocurrency — $454 million

- 💵 Cash — $156 million

Most Frequently Used:

- 💳 Credit Cards — 26% of reports

- 🎁 Gift Cards — 16% of reports

- 📱 Payment Apps — 14% of reports

Pro tip: If someone asks you to pay with gift cards, cryptocurrency, or by wiring money—it's a scam. Every. Single. Time.

👴 The 80+ Factor

People aged 80 and over face a particularly harsh reality:

- Median loss: $1,650 (the highest of any age group)

- 16% of their fraud reports are filed by family members on their behalf

- Phone calls remain their #1 scam contact method (not social media)

- Third-party reports for this group show median losses of $6,000

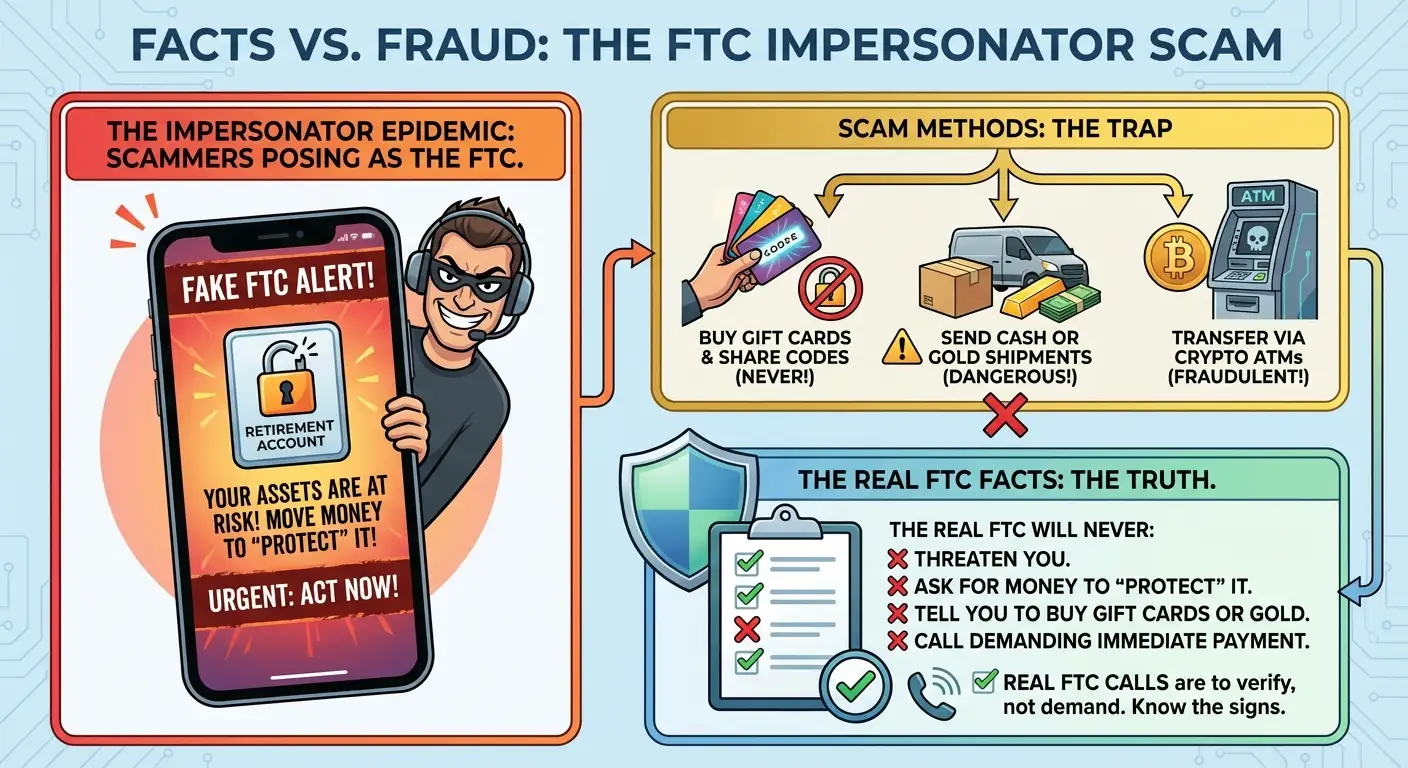

🚨 The FTC Impersonator Epidemic

One particularly cruel scam: People pretending to BE the FTC.

These scammers tell victims their money—including retirement accounts—is "at risk" and must be moved immediately to "protect it." They demand victims:

- Buy gift cards and share the codes

- Send cash or gold (yes, actual gold)

- Transfer money to cryptocurrency ATMs

The FTC has started personally calling older adults who report these scams to make sure they know it's fake. Imagine having to convince someone that YOU'RE the real FTC after a scammer already got to them.

Remember: The real FTC will NEVER:

- ❌ Threaten you

- ❌ Ask you to transfer money to "protect" it

- ❌ Tell you to buy gift cards or gold

- ❌ Call demanding immediate payment

🌟 The Silver Lining

Here's some genuinely good news buried in the data:

Older adults are actually BETTER at spotting scams they don't fall for.

They report fraud at higher rates overall but lose money at lower rates than younger adults. About 74% of fraud reports from older adults indicate no monetary loss—they saw through the scam and reported it anyway.

Translation: Older adults are often catching these scams. They're just getting hit harder when they don't.

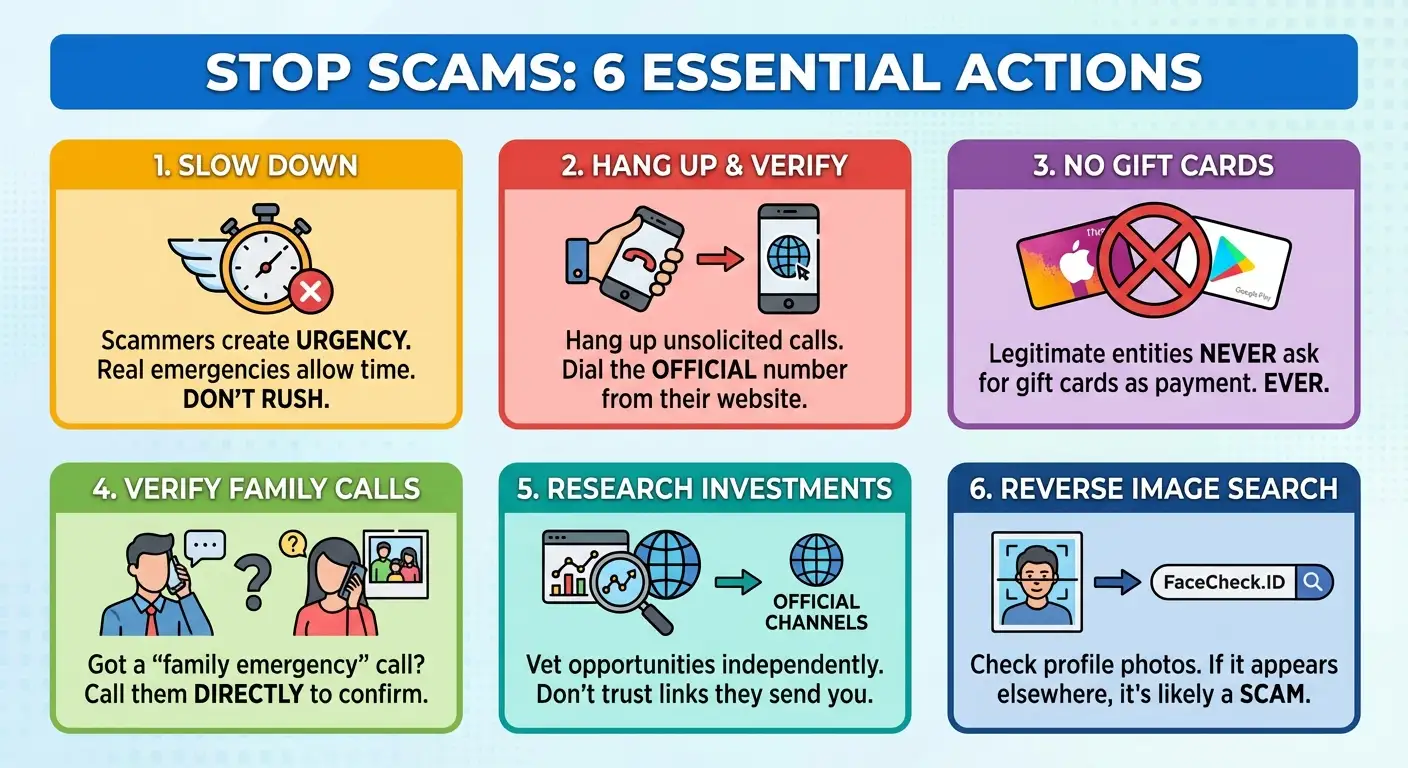

🛠️ What You Can Do TODAY

For Yourself (or to share with older loved ones):

- Slow down. Scammers create urgency. Real emergencies give you time to verify.

- Hang up and call back. If "Microsoft" or "your bank" calls, hang up and call the real number from their website.

- Never pay with gift cards. No legitimate business or government agency accepts iTunes cards as payment. Ever.

- Verify with family. Got a call that your grandson is in jail? Call him directly first.

- Check the source. Investment opportunity on Facebook? Research the company through official channels, not links they send you.

- 🔍 Use reverse image search on profile photos. The FTC specifically recommends this for spotting romance scammers. If someone's photo shows up under different names or doesn't match their story, it's a scam. Face search tools you can use:

- FaceCheck.ID — facial recognition search engine

- PimEyes — face search engine

- SocialCatfish — identity verification & people search

For Adult Children:

- Have the conversation (without being condescending). Share specific scam examples.

- Set up a "family password" for emergencies so you can verify identity in "grandparent scams."

- Offer to be a second opinion before any major financial decision.

- Help them report. If they DO get scammed, report it at ReportFraud.ftc.gov

🔗 Resources

- FTC's "Pass It On" Campaign: Free materials at ftc.gov/passiton

- Report Fraud: ReportFraud.ftc.gov

- Spanish Resources: ftc.gov/pasalo

The Bottom Line

Fraud against older adults has become a $2.4 billion industry—and that's just what we know about. Scammers are sophisticated, persistent, and constantly evolving their tactics.

But so are we.

Share this with someone you love. Have the conversation. Be the person they call before sending money to anyone.

Because the best defense against scammers isn't technology—it's trust.

Data source: Federal Trade Commission, "Protecting Older Consumers 2024-2025" (December 1, 2025)

Did you find this helpful? Pass it on. 🔄

That's literally what the FTC wants you to do.

Read More...

Uncover the Truth Before Your First Date

That profile pic looks perfect - but is the person behind it real? Romance scammers, catfishes, and even sex offenders use dating apps every single day. Here's the one verification step that can reveal criminal records and fake identities before you agree to meet up.

Popular Topics

Face Recognition Search Engine Face Recognition Search Face Search Engine Identity Social Media Image Search Facial Recognition Reverse Face Search How To Facebook Scammers Romance Scammers Romance Scam PimEyes Face Search Identity Verification ImpersonationFace Search Faceoff: PimEyes vs FaceCheck - Detailed Analysis