Synthetic Identity Explained: How It’s Made & Used

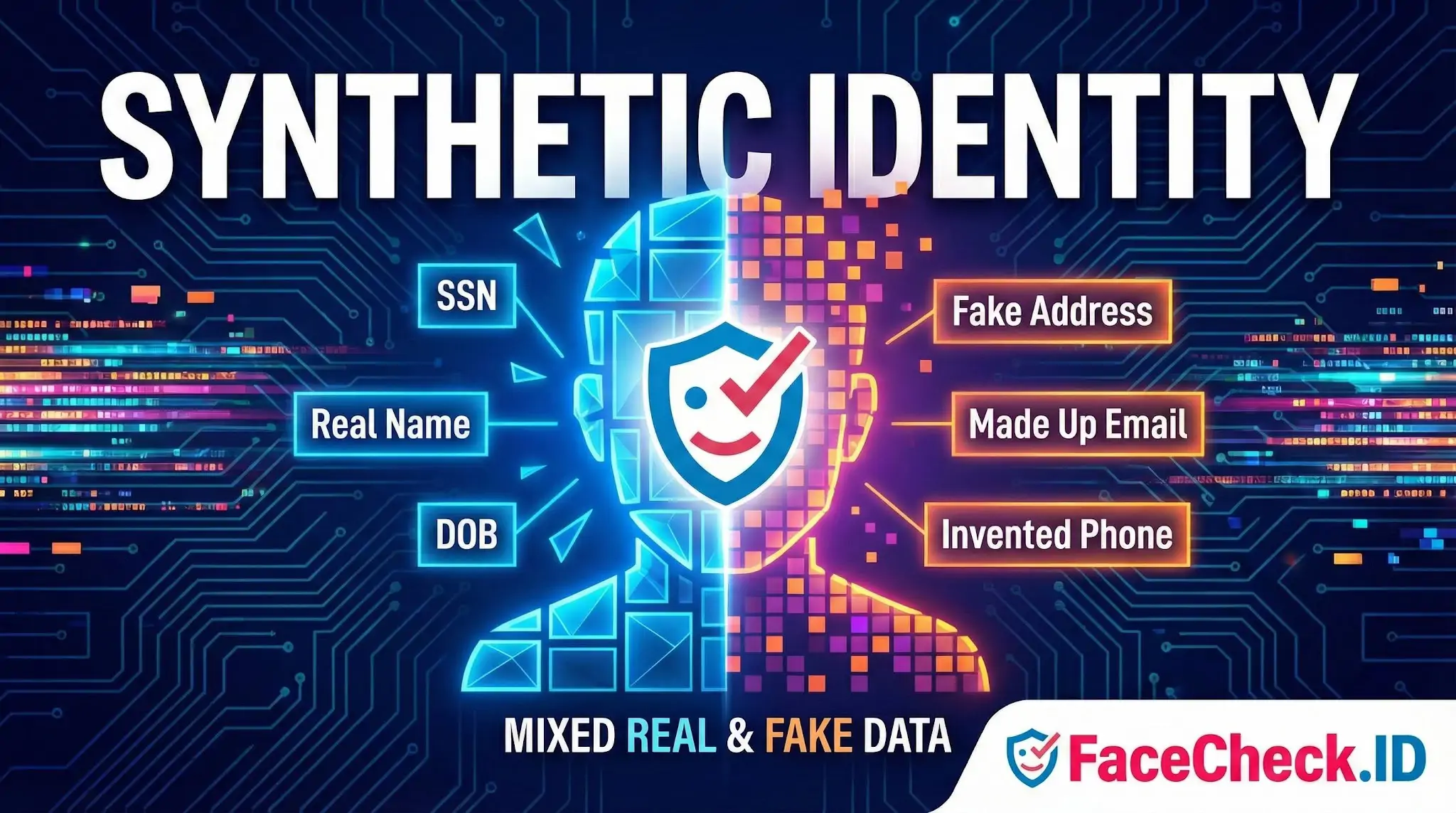

A synthetic identity is a fake but believable identity created by combining real and invented personal information to impersonate a person who does not actually exist. It is commonly used for fraud, especially to open bank accounts, apply for credit, take out loans, or bypass identity verification checks.

Unlike classic identity theft, a synthetic identity often uses partial real data such as a real Social Security number or national ID number combined with fake details like a made up name, date of birth, address, phone number, or email.

How a synthetic identity is created

Fraudsters typically build a synthetic identity by mixing data elements, then gradually making the identity look legitimate. Common building blocks include:

- A real government issued number (such as SSN) that belongs to someone else, sometimes a child, elderly person, or someone with limited credit history

- A fake name and date of birth

- A controlled email address and phone number

- A mailing address that can receive mail, sometimes a drop address

- Supporting documents that may be forged or manipulated, depending on the verification method

Over time, the fraudster may apply for small forms of credit, pay on time, and increase limits. This helps the synthetic identity develop a credit profile, making it easier to commit larger fraud later.

Synthetic identity fraud vs identity theft

Synthetic identity fraud and identity theft are related but not the same.

- Identity theft usually targets a real person and uses their full identity details to impersonate them. The victim often notices quickly due to account takeover or unauthorized charges.

- Synthetic identity fraud creates a new fictional person by blending real and fake data. It can go undetected longer because there may be no obvious victim actively monitoring the identity.

Why synthetic identities are hard to detect

Synthetic identities are difficult to catch because they can look consistent across systems. Common reasons detection is challenging include:

- Data elements match basic validation checks, such as a valid SSN format

- The identity builds a history over time, including credit behavior and account activity

- Fraudsters use multiple channels and institutions, making patterns harder to spot

- Some verification processes rely heavily on knowledge based questions or easily obtained data

Common use cases of synthetic identity fraud

Synthetic identities are often used to:

- Open credit cards and lines of credit

- Obtain personal loans or installment financing

- Create bank accounts for money movement and laundering

- Pass KYC checks to access financial products

- Commit bust out fraud, where the fraudster builds trust, then maxes out credit and disappears

Key warning signs

Organizations often look for patterns that can indicate a synthetic identity, such as:

- Thin file or newly created credit profile with rapid growth

- Multiple identities tied to the same phone number, device, or address

- Inconsistencies between stated age and credit history timeline

- Frequent changes to contact information

- Failed identity verification attempts followed by successful ones using slightly altered details

How synthetic identity fraud is prevented

Prevention usually involves combining several controls, including:

- Strong identity verification that checks multiple independent sources

- Document and biometric verification for higher risk onboarding

- Device intelligence and behavioral analytics

- Monitoring for shared attributes across accounts such as addresses, phones, and devices

- Ongoing transaction monitoring and risk scoring over the customer lifecycle

FAQ

What is a “Synthetic Identity” in the context of face recognition search engines?

In face recognition search engines, a “Synthetic Identity” typically refers to a fabricated or blended persona where the “person” presented online is not a real, single individual—often created using AI-generated faces, face swaps, heavy editing, or by combining details from multiple real people. The goal is usually to look authentic enough to pass casual scrutiny while being hard to trace to a real person.

What face-search result patterns can suggest a Synthetic Identity (without proving it)?

Common warning patterns include: (1) the same face appearing across many unrelated names/usernames, (2) matches that cluster around “stock-photo-like” portraits or identical studio-style headshots on different sites, (3) inconsistent ages/ethnic cues/face shape across top matches, and (4) many near-matches that look extremely similar but never resolve to a consistent real-world footprint (e.g., no credible long-term accounts, friends, or history). These patterns are signals to investigate further—not proof.

Why can a Synthetic Identity produce confusing or mixed matches in face recognition search?

Synthetic identities often use AI-generated or heavily edited images that can sit “between” many real faces in feature space, leading to multiple plausible near-matches. Face swaps and beautification filters can also shift key facial landmarks and skin texture cues, so the search engine may return a blend of look-alikes, edited variants, or different people who share similar facial structure.

How can I use a face recognition search engine to check whether a profile photo might be synthetic or stolen?

Use multiple photos from the same profile (not just one) and compare whether results converge on the same real person/source. Open several high-ranking results and look for consistency: the same name, timeline, location, and long-running presence. If results scatter across unrelated identities, treat it as higher risk and corroborate with non-face signals (reverse image search for exact duplicates, account history, cross-platform consistency, and direct verification steps appropriate to your situation).

How does FaceCheck.ID add value when investigating a possible Synthetic Identity?

Tools like FaceCheck.ID can help by finding where a face (or close variants of it) appears across the web, which can reveal reuse patterns—such as the same face tied to multiple identities, repeated across scam/report pages, or circulating as a “template” image. The safest approach is to treat any FaceCheck.ID match as an investigative lead: verify each source page, prioritize original uploads over reposts/screenshots, and avoid concluding identity from a face match alone.

Recommended Posts Related to synthetic identity

-

How to Spot a Catfish in 2025: Red Flags in Fake Dating Profiles

In 2025, the rise of AI, deepfakes, and synthetic identities has made spotting a catfish more critical than ever.

-

How to Spot a Catfish Online in Under 60 Seconds with FaceCheck.ID

These synthetic identities have no genuine online footprint, making them nearly impossible to trace with conventional reverse image search tools.

-

How to Detect Fake Remote IT Workers with Facial Recognition (2026 Guide)

Stolen or synthetic identities.